Top 3 Ways Data Science Benefits Pakistan in the FinTech Industry

Recently, data science has revolutionised major industry sectors in Pakistan, including banking, health care, the service sector, and much more. Better yet, many businesses in the FinTech industry have begun to use data science. Well, this application can help to quickly solve various business problems. But in what ways data science benefits Pakistan in the FinTech industry? Let’s find out!

Data Science Benefits Pakistan – Know the Definition

Data science today has been a widespread topic in this digital business world as a process of storing, collecting, and analysing data. Then, this valuable data enables businesses to carry out data-driven decision-making properly. In fact, many businesses today understand how data science benefits Pakistan as it helps a lot in their decision-making process.

What Is FinTech?

In general, FinTech is a combination of 2 terms, which are “financial” and “technology.” So, as the name suggests, we can define FinTech as the way businesses use technology to automate financial services and processes. From mobile banking and insurance to investment apps, FinTech provides user-friendly applications.

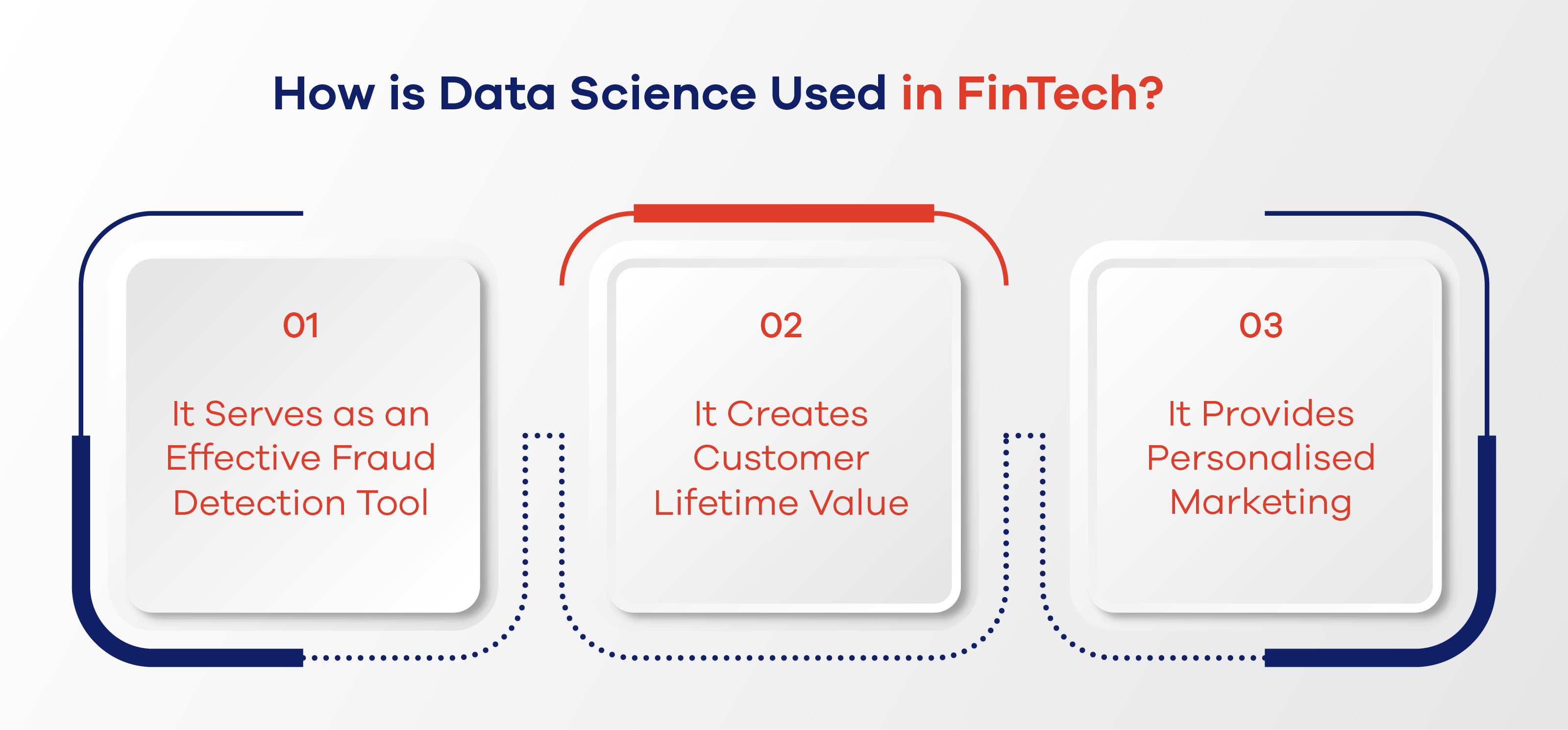

How is Data Science Used in FinTech?

Along with the growth of its uses, data science has become a trend for various FinTech applications to solve business problems quickly.

Have a look at some most common use data science in the FinTech industry!

1. It Serves as an Effective Fraud Detection Tool

For every financial institution, fraud prevention tools are important to automate risk management. As we know, there are several types of fraud attempts to imitate, steal, or carry out money laundering schemes. To tackle this, the FinTech companies use data science scanning to define the patterns of fraud. Simply put, data science works as an effective anti-fraud tool helps in prevention, protection, and reporting systems from fraud.

2. It Creates Customer Lifetime Value

Another explanation of how the link between FinTech and data science benefits Pakistan is from statistics on users’ financial behaviour. The statistics help FinTech companies create product strategies. In this context, the metric that data scientists provide to FinTech will show the customer lifetime value (CLV), which is a projection of the benefits a company can get from a customer relationship.

3. It Provides Personalised Marketing

Many businesses consider personalised marketing as the most powerful tool when it comes to promoting FinTech products. Well, data science makes it possible to analyse user behaviour patterns. Ultimately, it will suggest relevant financial products and services to users.

How Is the Fintech Landscape in Pakistan?

In this digital age, about 118 million citizens in Pakistan have easy internet access now. In fact, the numbers account for 54% of the population. Moreover, the mobile penetration rate has surpassed 77% in the country, indicating a significant increase in mobile phone users. Overall, this also shows us that fintech can be a booming industry in Pakistan if the country can provide the resources.

Furthermore, Pakistan today adopts a mixed cash-based economic system. No doubt, most people in Pakistan still prefer dealing in cash and are sceptical of digital methods. On the other hand, digital banking has also made many business transactions in the country to be cash-free.

Future Opportunities for Fintech Companies in Pakistan

Considering how the strong link between FinTech and data science benefits Pakistan, many financial institutions have recognised the promise of FinTech.

As for today, FinTech companies in Pakistan mainstream some specialised fields. What are they?

Mobile Wallets Replace Credit Cards

Some specific trends in the future might partially change the way Pakistani people make their payments. With the support of FinTech industry, mobile wallets or digital payments will be beneficial as people can easily make payments through mobile phones. Better yet, people see the similar benefits and point systems of mobile payments as those of credit cards.

Online Loan Services

Thanks to the growth of online loan service providers, seeking loans or credit will be more convenient and easier. Well, in the coming three to four years, we can expect to see Pakistan adopts this trend. Eventually, some Fintech companies have been offering a one stop solution for customers to compare multiple financial products like insurance, loans, investment.

Insurtech

From the name, we can define Insurtech as a combination of insurance and technology. This innovation signifies the amalgamation of insurance with innovative technology. Well, we know that insurance is one of the oldest businesses. In addition, with the need for technological innovation in Pakistan, it is the right time for FinTech companies to step in.

Data Science Benefits Pakistan with More FinTech Professionals

Overall, the future for the FinTech setting in Pakistan holds a brilliant potential that businesses cannot ignore. Even better, Pakistan is noted as the world’s 5th largest young population. Besides, the Pakistani market shows the potential of adapting to the new financial technologies with more people using the internet and smartphones.

In order to support the use of data science in FinTech, Pakistan needs more expert BS FinTech. Yes, the growth of data science benefits Pakistan will be in accordance with the needs of FinTech professionals. Responding to this, Muhammad Ali Jinnah University (MAJU) offers the best undergraduate program of BS FinTech. Being the technology-based university, MAJU is now a pioneer institution in Karachi to get a BS Degree in Financial Technology.